Soft1 Series 5: For the first time, banking through software

SoftOne, a member of the Olympia Group of Companies, is once again redefining the business software market, ushering in a new era in the implementation of enterprise banking.

Taking new dimensions to the concept of process automation, the company introduces the innovative Soft1 FinTech function, making the processing of everyday banking transactions of the modern business a reality, directly from its commercial software.

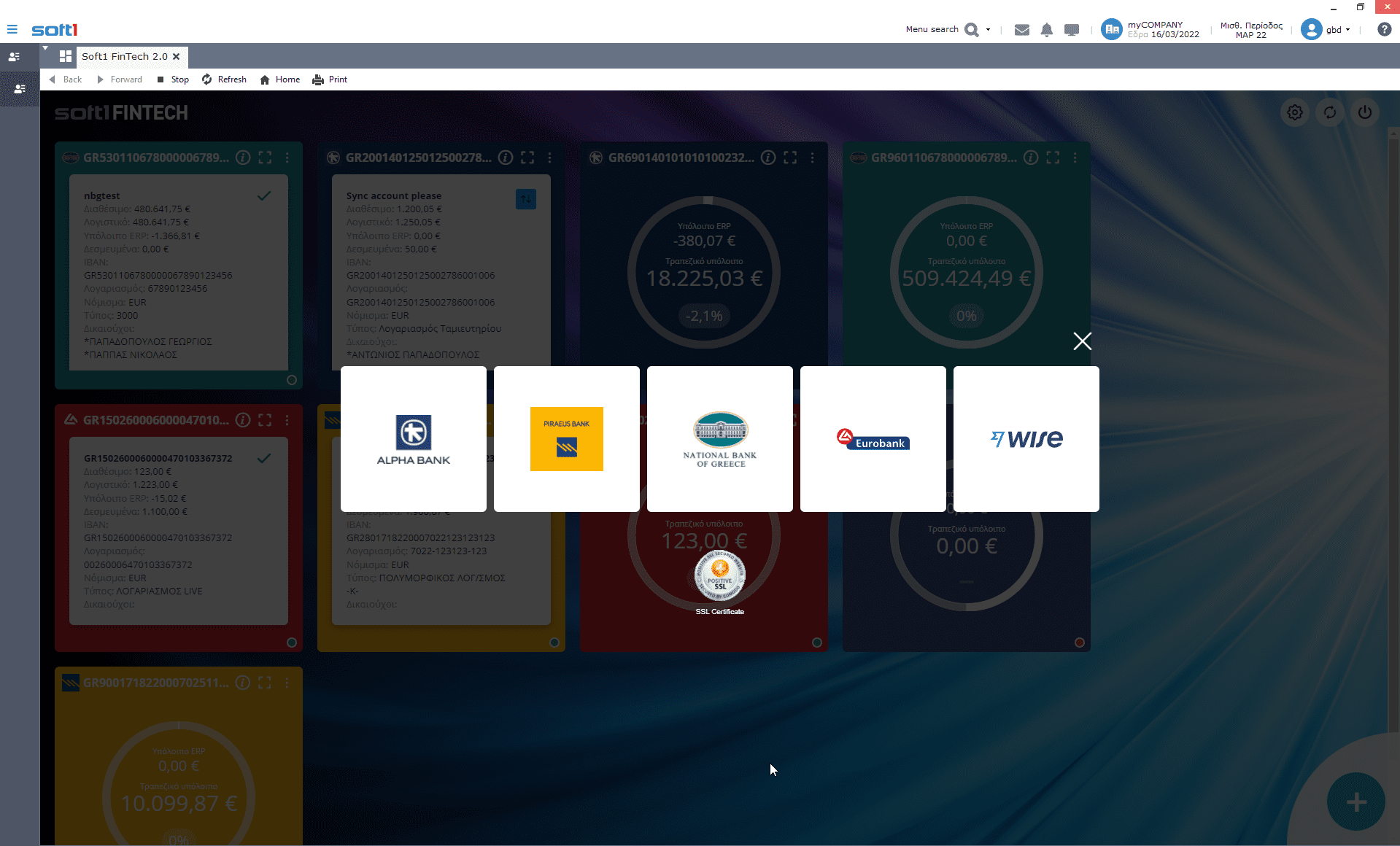

The Soft1 FinTech function achieves the seamless and secure interconnection of Soft1 Series 5 applications with banks’ e-banking systems. In this way, it helps the business to manage their bank accounts through the Soft1 Series 5 interface, viewing in real time their balance and movements, but also ensuring their agreement with the system records.

With innovative technologies, as well as the validity of bank details, the Soft1 FinTech module allows the Soft1 Series 5 to be instantly updated on all account movements (such as remittances, money transfers, bank charges and expense payments), automatically generating all relevant records and documents. At the same time, it provides the ability to carry out banking transactions (such as sending remittances, transfers and paying expenses), directly through the corresponding modules of the Soft1 Series 5.

The Soft1 FinTech function is now operational for all Soft1 Series 5 commercial combinations, supporting the National Bank e-banking system, while the integration process of the remaining banks is also underway.

Mr. Giorgos Marinos, Director of Digital Transformation of National Bank, said about the new Soft1 FinTech function: “SoftOne’s software solution works perfectly with National Bank’s online services, supporting in practice the operation of a modern and practical fintech tool that it broadens the perspectives of businesses, whether they are startups or traditional organizations.”